SafeSend Tax Returns - DeDecker Wertz CPAs

SafeSend Returns™ At DeDecker Wertz

At DeDecker Wertz, we’re always looking for ways to make your taxes less of a hassle, and offering SafeSend Returns™ is one of the ways we do it.

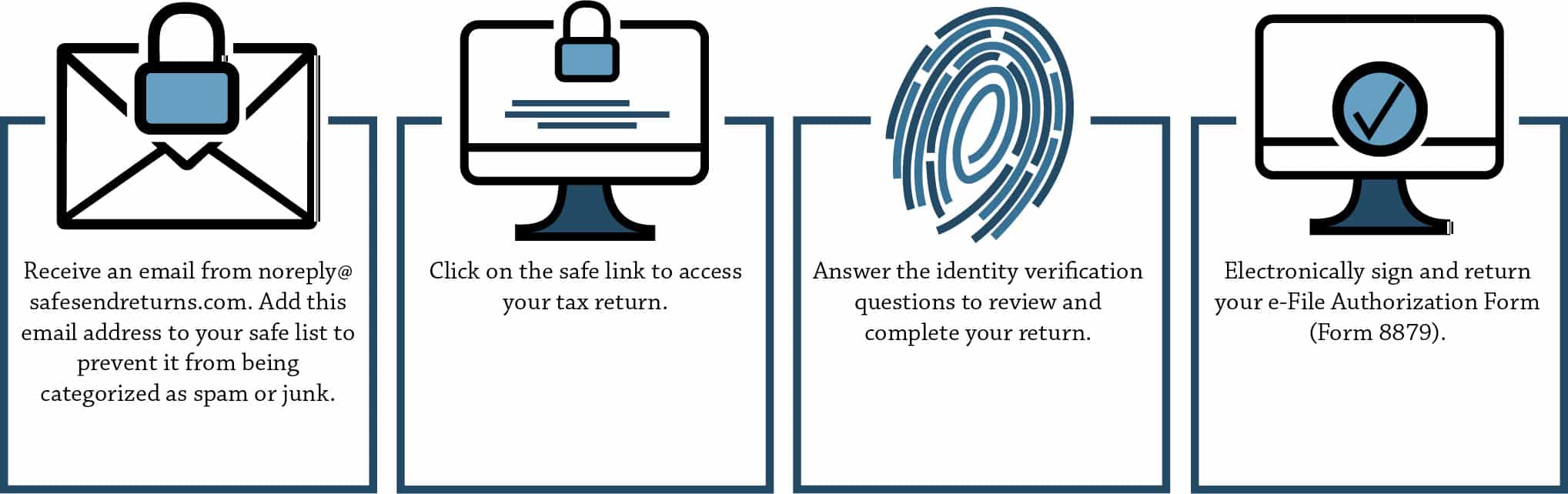

SafeSend Returns™ streamlines the process of filing your taxes without sacrificing your personal security. From the convenience of your smartphone, tablet, or computer, follow the user-friendly step-by-step instructions to manage the delivery, review, and signature of your federal and state tax returns.

After you’ve finished filing, you will have the option to save a PDF file of your tax documents to your device or access your tax forms at any time via email.

And no need to worry — SafeSend Returns™ uses a secure identity verification process to protect your personal information.

Why SafeSend Returns™?

Whether you run a business or a household, SafeSend Returns™ can make taxes simple for everyone.

- E-sign your federal and state returns

- Pay your taxes

- Pay your tax preparation fee

- Receive estimated tax payment reminders

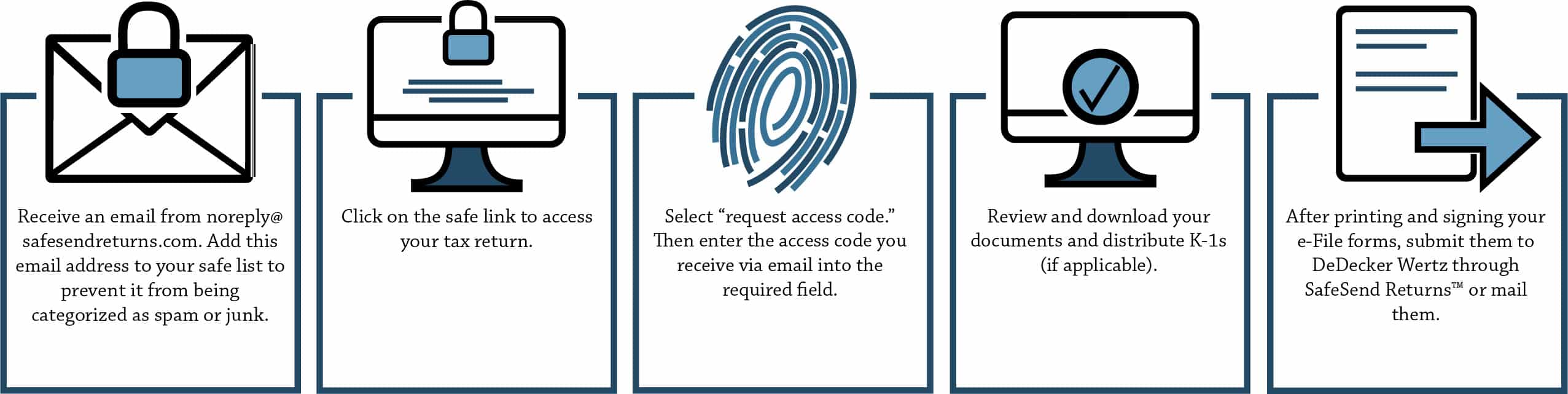

- Download, sign, and conveniently distribute K-1s electronically

- Electronically sign, save, and print tax documents

- A live link to tax documents for up to three years

- Electronically access payment vouchers and receive email reminders of payments due

- Forward tax documents to bankers and other professional advisors through a secure email link

Going Green

- No more ink, postage or paper, which reduces your total carbon footprint and helps protect the environment

How Does SafeSend Returns™ Work?

Still Have Questions?

Even with simple processes, we understand there can still be hiccups. For that very reason, we have compiled a list of common questions and answers about SafeSend Returns™ as well as some helpful links directly from the source.

- What if I don’t receive an email with my access code?

- Will this work on any internet-connected device? Does SafeSend Returns offer an app for my smartphone?

- Will I have the option to download and print my return to retain for my records?

- Can I set up reminders for my quarterly estimated payment?

- What about my source documents? What happens to them?

The email with your access code will not be generated until you click “request access code.” If you do not see the email, check your spam/junk email folder or search your email for noreply@safesendreturns.com. Some email providers hide items they’ve labeled spam or junk making certain emails difficult to find. If you do not receive your code within the 10-minute time limit, please request another code.

There is currently no SafeSend Returns app available, but the signature process can be completed on any computer, smartphone or tablet via a web browser.

Yes. If you’re using a smartphone or tablet, you may not be able to download and print your return, but you will be able to review and electronically sign it. Don’t worry — you can always download and print your return from your personal computer at a later date.

If estimated payments are included in your review copy, you will automatically receive an email reminder seven days before your payment is due.

DeDecker Wertz CPAs will return your source documents to you via separate mailing.